Goldman Sachs Bonuses Face Scrutiny: Glass Lewis Slams Executive Compensation

Goldman Sachs, one of Wall Street's giants, is facing renewed criticism over its executive compensation practices. Proxy advisory firm Glass Lewis has issued a scathing report, urging shareholders to vote against the firm's executive compensation plan at the upcoming annual meeting. This development highlights growing concerns about excessive executive pay, particularly in the wake of a year that saw mixed financial performance for the investment banking behemoth.

Glass Lewis's Key Concerns

Glass Lewis's report zeroes in on several key areas, arguing that Goldman Sachs's compensation plan fails to adequately align executive pay with company performance and shareholder interests. Specific criticisms include:

-

Unjustified Payouts: The report alleges that substantial bonuses were awarded despite the firm's underperformance in certain key areas, suggesting a disconnect between reward and results. This is particularly concerning given the current economic climate and pressures facing the financial sector.

-

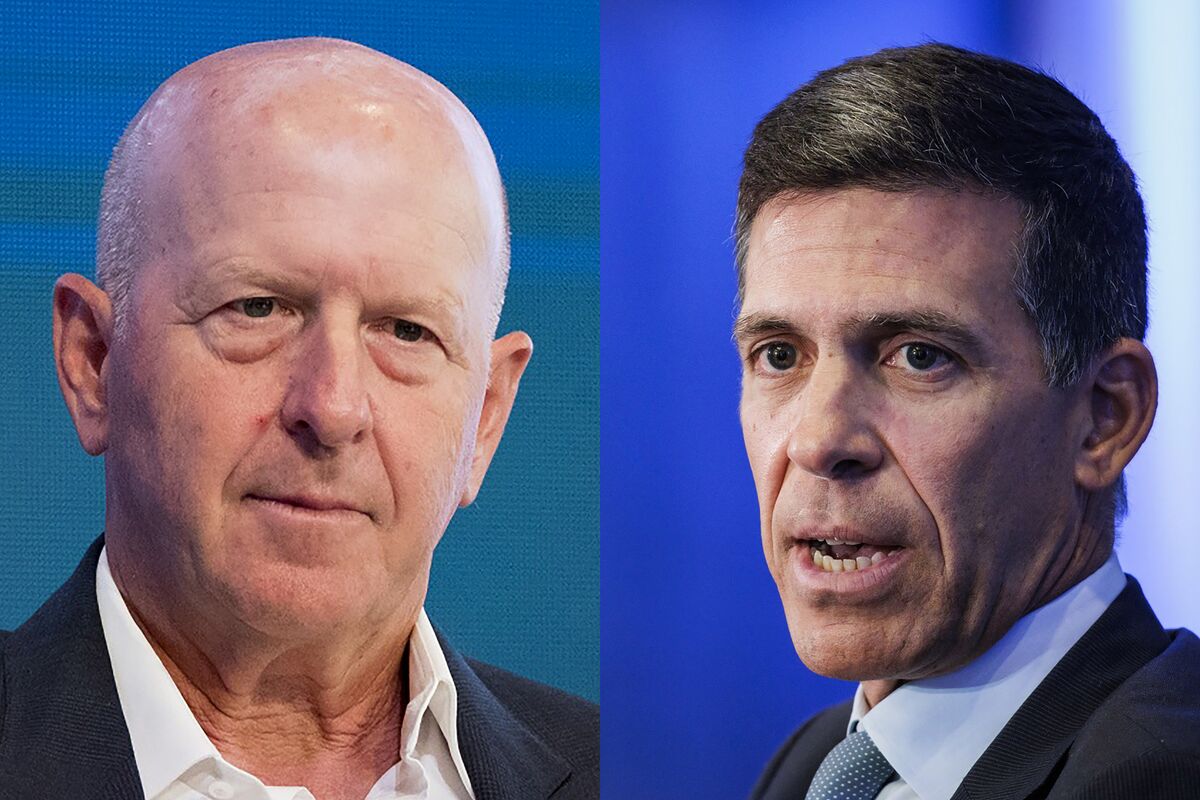

Excessive CEO Compensation: The report points to the substantial compensation package awarded to CEO David Solomon, arguing that it is disproportionate compared to the firm's overall performance and the compensation of CEOs at peer institutions. This disparity fuels the narrative of excessive executive pay within the financial industry.

-

Lack of Transparency: Glass Lewis expresses concerns about the lack of transparency surrounding the bonus allocation process, making it difficult for shareholders to assess the fairness and justification of the awarded payments. Greater transparency, they argue, is vital for restoring trust and accountability.

-

Performance Metrics: The firm criticizes the performance metrics used to determine executive compensation, suggesting they are too easily manipulated or do not accurately reflect the long-term value created for shareholders. A more robust and objective framework is demanded for evaluating executive contributions.

Goldman Sachs's Response

Goldman Sachs is yet to issue a formal, detailed response to Glass Lewis's report. However, the firm has historically defended its compensation practices by highlighting the complex nature of its business and the need to attract and retain top talent in a highly competitive environment. They may argue that the short-term performance fluctuations do not fully reflect the long-term value creation efforts of its executives.

The Broader Implications

The criticism leveled by Glass Lewis is not an isolated incident. It reflects a broader societal and investor sentiment increasingly questioning the fairness and effectiveness of executive compensation packages, particularly in the financial industry. This growing scrutiny is pushing companies to re-evaluate their compensation strategies and prioritize greater alignment with long-term shareholder value creation.

What Happens Next?

The upcoming shareholder vote will be a crucial test of the strength of investor sentiment. If a significant portion of shareholders heed Glass Lewis's recommendation, it could signal a shift in the dynamics of executive compensation at Goldman Sachs and potentially influence practices across the broader financial industry. This event will be closely watched by investors, regulators, and the public alike, demonstrating the increasing demand for accountability and transparency in corporate governance.

Call to Action: Stay tuned for updates on the shareholder vote and its outcome. What do you think about the criticism of Goldman Sachs's bonus structure? Share your thoughts in the comments below.

Keywords: Goldman Sachs, Bonuses, Executive Compensation, Glass Lewis, Shareholder Vote, Proxy Advisory Firm, Wall Street, Financial Industry, Corporate Governance, CEO Pay, David Solomon, Performance Metrics, Transparency, Accountability.